When you buy or refinance a house, you naturally want the best mortgage rate available to you. And if you follow these four tips, you’ve got a great chance at getting it.

What Affects Your Mortgage Rate?

You probably know that everyone is not offered the same mortgage rate, even by the same lender. Your rate depends on several factors:

- Borrower risk profile. The most desirable borrowers are those with excellent credit, a substantial down payment (or lots of home equity if refinancing), buying a single-family primary residence.

- Shopping behavior. Studies show that consumers who shop more pay less. Obtaining multiple loan quotes really does get you a lower mortgage rate.

- The mortgage product you choose. The rate you pay depends on the loan terms.

- The loan amount. In general, the larger the loan, the higher the rate.

- Self Improvement

- Shop ‘Til Your Rate Drops

- Choose the Right Loan

- Think Smaller You can save more by borrowing less.

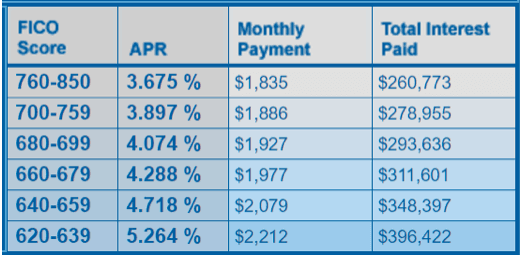

The best thing you can do for your financial health and your mortgage rate is to improve your credit score. The example below, using real mortgage data from MyFICO.com, illustrates how credit scoring affects what lenders are willing to offer for a $400,000 home loan. How do you improve your credit score? Check your credit report and scores at www.annualcreditreport.com, a free government site. You can also inexpensively purchase your scores. The “reason codes” on your credit report tell you what’s lowering your FICO score. If it’s high credit utilization, for instance, you can solve that by paying down balances, increasing your credit limits, or both. If it’s overdue bills, you’ll probably have to make your payments perfectly for six to 12 months to see significant gains.

Recently, the Consumer Financial Protection Bureau reported that only about half of borrowers shopped with multiple lenders for their home loans. That’s a big mistake, because the only way to know if you’re getting the best deal is to compare several offers. Analysts at MIAC Analytics concluded that rates vary by .25 percent to .50 percent among lenders on any given day, and studies at both Stanford and Harvard concluded that competing for business forces mortgage lenders to offer lower rates. In addition, the Harvard study found that most borrowers went with local banks, and those banks tended to price higher when there was less local competition. Shopping outside your local area (easy to do online) may really pay off if you’re in an area dominated by a handful of large institutions.

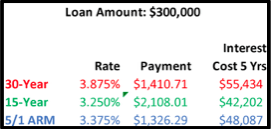

The 30-year fixed loan is often the only one people consider, and that’s a mistake. Most homeowners sell or refinance long before they pay off a 30-year mortgage, and an adjustable loan with an introductory rate could save thousands. These ARMs are called 3/1, 5/1, 7/1 and 10/1 loans, and their rates are fixed for three, five, seven or ten years. If you have the income to support a higher payment, you can save .5 to 1.0 percent on your interest rate with a 15-year mortgage. The table below shows how much you could save at current mortgage rates with a 5/1 mortgage and a 15-year fixed loan. (Data courtesy of TheMortgageReports.com) Not everyone should go with a shorter term. If the possibility of future rate increases keeps you awake at night, or you can’t afford the higher 15-year mortgage payment, the classic 30-year loan might still be your best option.

That’s because loans with lower loan-to-value (LTV) ratios come with better rates. You can eliminate the cost of mortgage insurance by putting at least 20 percent down. If you can’t pay that much, you can still reduce your MI premiums by increasing your down payment. Finally, remember that just because you qualify to “push the envelope” with a bigger mortgage doesn’t mean you should. A $20,000 down payment goes a lot further when you buy a $200,000 house than a $400,000 house. You Have (Some) Control Some factors that shape mortgage rates, like the economy, are out of your hands. But many are not, and you can find your best rate by controlling what you can – your credit, shopping, mortgage product and loan amount.

*Article written for Coffey & Company Fine Homes International courtesy of Melissa McAllister at themortgagereports.com